Slapping Tariffs While Importing Billions: The Contradictions of U.S. Trade Policy on RussiaPresident Donald Trump’s threats of “very substantial” secondary tariffs on countries importing Russian energy come amid a startling reality: the United States itself remains a major buyer of Russian uranium, palladium, fertilizers and specialty chemicals. As Washington rails against Moscow’s war in Ukraine, billions of dollars continue flowing into Russian state coffers through exemptions and loopholes in U.S. sanctions. This deep‐dive examines how America’s own import dependencies undermine its moral high ground—and what it would take to craft a truly consistent policy.

The Energy Tariff Ultimatum

In early August, President Trump publicly warned nations like India that they faced punitive duties if they “refuse to honor our sanction regime” on Russian oil and gas.

Yet U.S. Customs and trade data reveal that while Russia’s hydrocarbons face steep financial barriers, strategic materials critical to American industry sail through largely unscathed. The administration’s choice to threaten one sector while preserving others raises questions about the coherence and equity of its sanctions strategy.

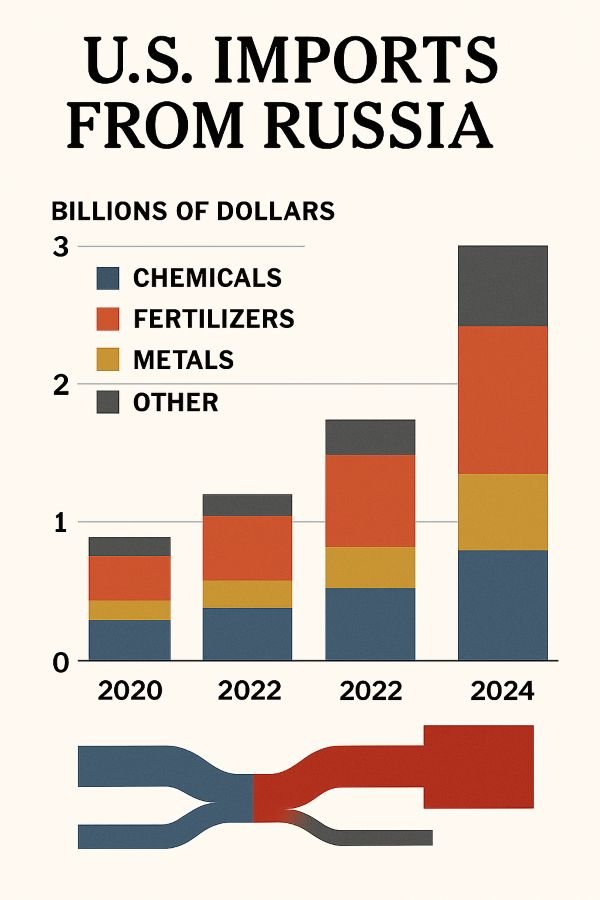

Hidden Reliance: U.S. Imports from Russia in 2024

Despite broad energy sanctions, U.S. buyers imported large quantities of Russian commodities last year.

From nuclear power to electric vehicles, these imports play pivotal roles in U.S. supply chains—yet receive far less scrutiny than crude oil or natural gas.

The $2.1 Billion Dilemma: January–May 2025

Through May 2025, U.S. shipments from Russia climbed 23 percent over the same period in 2024, totaling $2.1 billion.

These figures stand in stark contrast to threatened penalties for oil and gas, spotlighting internal contradictions in enforcement.

Mapping Dependence: U.S. States Most Reliant on Russian Imports

Below is a placeholder for a New York Times–style choropleth map, illustrating states with the highest Russian import values in 2024.

Midwestern agricultural hubs and manufacturing centers show up prominently, reflecting fertilizer usage and heavy‐industry demand.

“I Don’t Know Anything About It”—The Press Conference Exchange

On August 5, an ANI reporter pressed President Trump: “India says the U.S. buys Russian uranium and fertilizers while criticizing them for energy imports. Your response?”

This off-hand reply underscored a broader conversation in Washington: even senior officials acknowledge gaps in policy coherence, fueling criticism that U.S. rhetoric outpaces real action.

Financing the War Machine by Default

Every dollar spent on sanctioned-exempt goods filters through Russian state channels. A simplified flow of money shows how U.S. purchases bolster Moscow’s budget:

- U.S. nuclear utilities → Russian uranium producers → Russian federal budget

- American EV manufacturers → Russian palladium mines → Defense spending

- Midwest farms → Russian fertilizer exporters → War chest

Without extending secondary sanctions to these strategic materials, the U.S. inadvertently undercuts its stated goal of economically isolating Russia.

Toward a Coherent Sanctions Strategy

To align policy with principle, Washington could:

- Impose uniform secondary tariffs on all Russian exports, including minerals and fertilizers

- Expand sanction exemptions only under narrow, transparent criteria (e.g., proven lack of alternatives)

- Partner with allies to develop substitute supply chains, reducing global market disruptions

- Strengthen domestic production of critical inputs through tax incentives and R&D funding

Such measures would close loopholes and ensure that U.S. demands for allied compliance apply equally at home.

Looking Ahead

The debate over Russian sanctions is far from settled. As legislative discussions on Capitol Hill explore new enforcement tools, industry lobbyists will push back against any trade-wide penalties. Meanwhile, allies like India and the EU will gauge whether America’s moral authority remains intact—or if U.S. policy will continue to be viewed as a case of “do as I say, not as I do.”