In a barrage of tweets and tariff threats, President Donald Trump labeled India a “dead economy,” imposed a 25% tariff on its exports, and vowed to hike levies further unless New Delhi stopped buying discounted Russian oil. Yet Europe, China, and even the United States continue to purchase vast volumes of Russian energy. Trump’s one-sided pressure risks alienating a fast-growing partner, undermining US–India ties, and driving India deeper into Moscow’s orbit.

Background: Trump’s Tariff Escalation Against India

On July 31, Trump announced 25% reciprocal tariffs on Indian imports, accusing India of “high tariffs among the highest in the world” and of “profiting off Russian oil” by reselling refined products. He followed up on Truth Social:

“I will be substantially raising the Tariff paid by India to the USA because they are buying massive amounts of Russian Oil and selling it for big profits. They don’t care how many people in Ukraine are being killed.”

US Trade Representative Katherine Tai echoed frustration, blaming India for “slow-rolling” negotiations while keeping its strategic purchases from Russia intact.

India’s Steely Rebuff

India’s Ministry of External Affairs branded Trump’s threats “unjustified and unreasonable,” stressing that its energy imports are driven by economic necessity, not geopolitics. Key points from the official statement:

- India ramped up Russian crude after traditional suppliers diverted shipments to Europe amid sanctions.

- At Washington’s own urging, India boosted purchases in early 2022 to stabilize global energy markets.

- Roughly 37% of India’s oil imports—about 1.8 million barrels per day—came from Russia in 2024, thanks to steep discounts.

- India remains the EU’s largest supplier of refined fuels, exporting €8.5 billion worth of diesel and jet fuel in 2023-24 processed from Russian crude.

These decisions reflect India’s sovereign right to secure affordable energy for 1.4 billion people.

Western Double Standards: Who’s Buying Russian Oil?

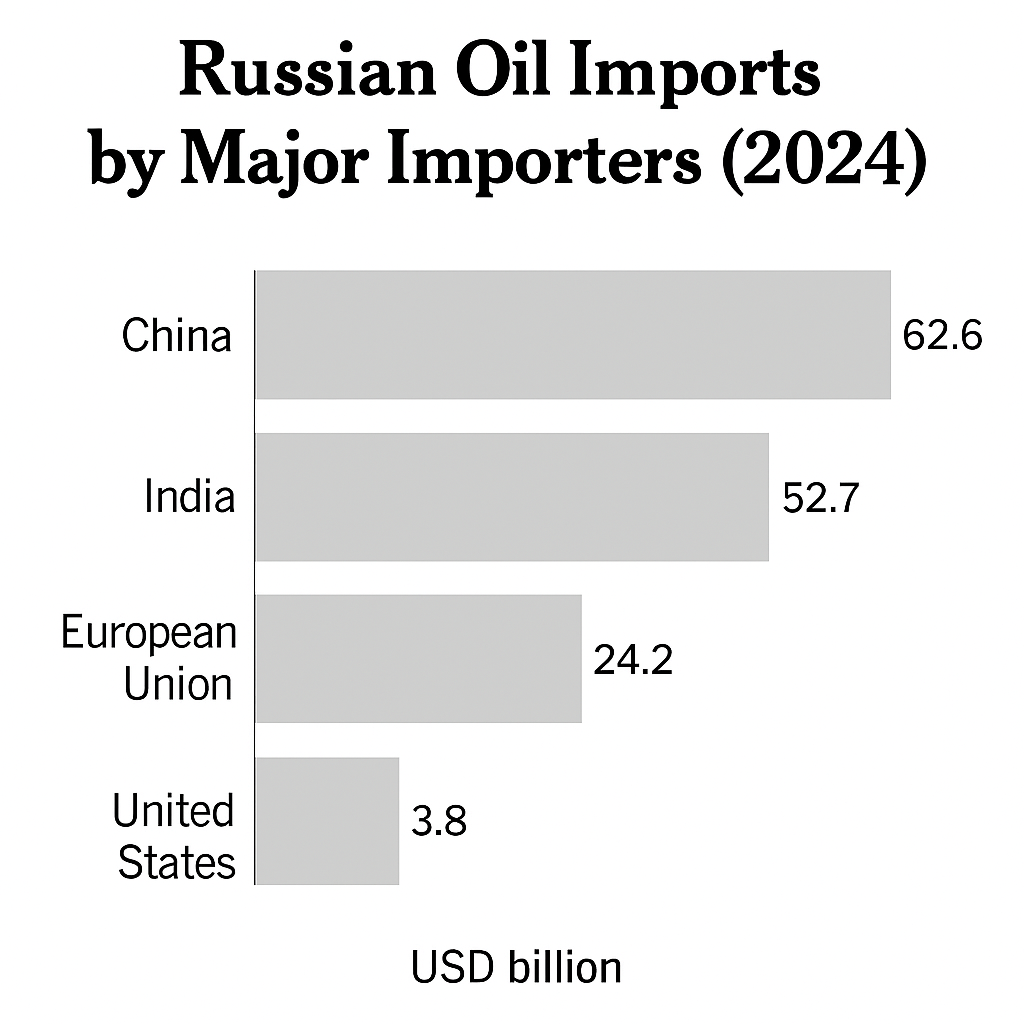

Trump singles out India, yet global data tell a different story:

- China imported USD 62.6 billion of Russian oil in 2024, making it Moscow’s top oil customer. Trump has not threatened China with retaliatory tariffs.

- India’s Russian oil bill stood at USD 52.7 billion the same year, roughly 16% less than China’s.

- The European Union’s total trade with Russia reached USD 70.3 billion in 2024, including USD 24.2 billion in oil imports—nearly half of India’s energy purchases from Russia—yet Brussels escapes Trump’s ire.

- The United States still buys fertilisers, uranium, and palladium from Russia worth USD 3.8 billion in 2024, with no comparable threat of US tariffs.

This selective targeting reveals geopolitical posturing rather than principled energy policy.

Economic Stakes: Who Pays the Price?

Indian refiners and manufacturers face the brunt of Trump’s actions:

| Sector | US Exports to India (2024) | Tariff Impact |

|---|---|---|

| Pharmaceuticals | USD 6.5 billion | Higher duties risk drug supply delays |

| Textiles & Apparel | USD 5.2 billion | 25% levy erodes competitiveness |

| Engineering Goods | USD 12.3 billion | Market share at stake |

| IT Services & Software | USD 45 billion | Investment sentiment weakened |

Tariffs not only punish Indian consumers through higher prices—they threaten to reroute global supply chains away from the US. Though Trump, till now, has been clever enough to keep these essential items out of the tariff circle.

Strategic Realignment: India Drawn to Russia

As US pressure mounts, India’s refusal to yield highlights its multipolar strategy:

- Nearly 40% of India’s crude now comes from Russia, up from below 1% pre-2022, securing stable, discounted supplies.

- Discounted Russian crude feeds India’s massive refining sector, which exported $19.2 billion in petroleum products to the EU in 2023-24.

- Experts warn that heavy-handed US tactics may cement a deeper energy-and-security partnership between New Delhi and Moscow, complicating US influence in Asia.

Conclusions: The Perils of Selective Sanctions

Trump’s tariff theatrics expose the hazards of wielding economic coercion selectively. India’s growth—projected at 6.5% in FY 2025–26 versus the IMF’s 3% global outlook—contrasts starkly with the “dead economy” label. By targeting India while overlooking larger Russian energy customers, the US risks:

- Fragmenting a key strategic partnership

- Driving India closer to Russia and China

- Undermining trust in American reliability

In a multipolar world, respect for sovereign choices and consistent policy matters more than tariff-driven grandstanding.

What next? Will the Biden administration recalibrate US-India trade ties, or will India chart an independent course amid great-power rivalry? Let’s explore how New Delhi’s balancing act will reshape the geopolitical landscape.